Purpose: Allows you to display, edit and add Cash Journal entries which are used to produce the budget and actual reports and to provide the cash transactions for the conversion to generally accepted accounting principles.

Where Used: Besides the budgetary worksheets, statements and schedules, the cash journal entries are used as a column in the modified accrual trial balance, the governmental restricted net assets trial balance, and the full accrual trial balance, as appropriate based on fund type.

Accounts used: The receipt, function and object codes available in the cash journal for schools are the USAS codes. Cities and Counties also have receipt codes, function and object codes defined for their respective entity type. If a city or county wants to import their cash transactions the import file must contain those defined receipt, function and object codes so Web-GAAP knows how to translate them for the various trial balances and published statements.

Note: To view imported cash transactions, use the cash journal report. Imported transactions cannot be edited in the cash journal.

Task Processing

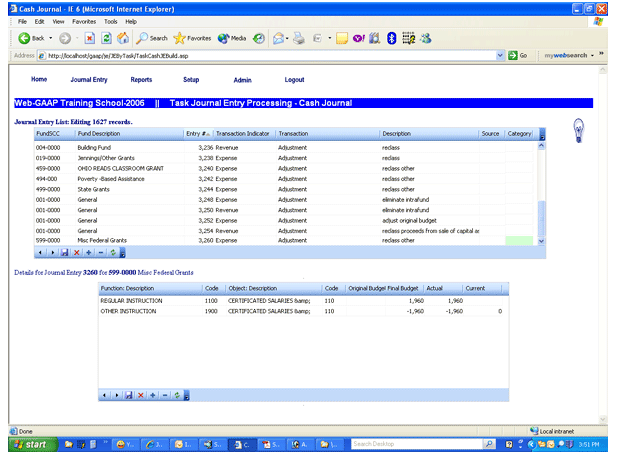

Several differences from the ASP Grid processing are immediately apparent. All entries entered in the cash journal are available in the header and detail grids. It is not necessary to limit the entries displayed in the header grid to those for one fund at a time.

Setting focus on an entry in the header grid will display that entry’s accounts and amounts in the detail grid.

The data within the header grid can be sorted by clicking on any field in the header grid top bar. For example clicking on FundSCC will sort the grid by fund-scc number and can be either ascending or descending order by simply clicking FundSCC again. For example if the screen is displaying FundSCC descending, clicking FundSCC will change it to FundSCC ascending.

That same sorting methodology will work for Fund description, Entry #, Transaction Indicator, Transaction Type, Transaction Description, Source, or Category.

The mouse icons on the bottom grid rows are as follows:

< - Previous record > - Next record Save changes X – Cancel changes + - Insert new record - - Delete record Refresh data

Adding a Journal Entry

With the cursor focus set in the header grid either hit “Insert” or Click on the “+” icon to insert a new line in the header grid for the new entry.

The following are the data fields for a header record:

- FundSCC – Allows the user to select the fund-SCC for which the entry is being entered by fund-SCC number. Selecting the fund-SCC number will populate the fund description.

- Fund description – Allows the user to select the fund-SCC for which the entry is being entered by fund description. Selecting the fund description will populate the FundSCC number.

- Entry # (number) – Transaction number assigned by the upload program, system or user. If you leave this field blank the system will assign the next available number.

- Transaction type – Adjustment, Audit Adjustment or Manual Cash Transaction. The type determines the column the entry appears in on the budgetary worksheet. The manual cash transaction is used in lieu of a cash transaction upload to record the general ledger balances and will not be available if cash transactions are uploaded. These uploaded amounts will post to the first set of columns, Cash Transactions, on the budgetary worksheet and should tie to the general ledger. Any reclassification or other change should either be recorded as an adjustment or audit adjustment as appropriate.

- TI (Transaction Indicator) – Cash balance, Expense, Revenue

- Description – General description of the transaction.

- Source – Transaction source – such as import or work paper reference.

- JE Category – This optional field allows the user to enter up to 4 characters to help them sort journal entries when generating journal entry reports.

You should enter data for the fund, transaction indicator, transaction type, description, and source and save the header record (* or click on the save icon). You can provide the journal entry number, rather than allowing the system to assign it.

Saving the header record will move the cursor to the detail grid. For transaction indicator, cash balance, the detail grid will have fields to adjust the prior year cash balance and prior year encumbrances. For transaction indicator, expense, the detail grid will have fields to adjust original budget, final budget, actual, and end of year encumbrances. For transaction indicator, revenue, the detail grid will have fields to adjust original budget, final budget, and actual. You can select the account by its code or description (the system will populate the other based on your selection) and enter the appropriate amount. You can enter account code or account descriptions or you can select from either’s drop down menu. When you have completed all of the accounts and amounts save the entry (* or click on the save icon on the bottom of the detail grid).

Entries in the detail grids in the cash journal are entered as positive or negative, rather than as debits or credits. To make an amount negative put the minus sign before the amount in the relevant amount field.

Copying a Journal Entry

With the cursor focus set in the header record of the entry you want to copy, hit the plus key. This will create a new header record with the data from the copied record. Select the fund to which you want to post the new entry and save the header record. This will populate the detail grid with the accounts used in the copied entry but the amounts will be zero. Enter the amounts in the detail grid and save the detail grid. You can add lines for accounts as needed or delete any unused lines. You can also edit the account in a copied line as needed.

Deleting a Journal Entry

With the cursor focus set in the header record of the entry you want to delete, hit the delete key. This will bring up a delete confirmation box asking if you are sure if you want to delete the entry. Clicking on OK or hitting enter will confirm the delete. Save the header grid (* or click on the save icon). The process is the same to delete a detail record.

Modifying a Journal Entry

With the cursor focus set in the header record of the entry you want to modify, you can modify any field in the header record or you can toggle (/) to the detail grid and modify any accounts or amounts. Save the grid you modified.