Program Revenue Journal Entries

Purpose: Program revenue journal entries affect the District-wide Statement of Activities. Program revenues are produced by the district or are provided externally for use in a particular function and thereby reduce the net expense to the public of that function. If revenues are not program revenues they are general revenues. Besides all taxes, general revenues include grants and entitlements not restricted to specific programs, payment in lieu of taxes, unrestricted contributions, investment earnings, and miscellaneous.

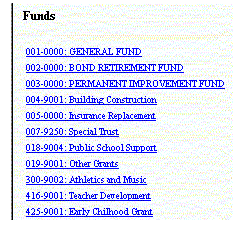

Select a Fund - SCC: In order to make Program Revenue Journal Entries, select and click on a specific fund. As an example, use the general fund, 001 - 0000.

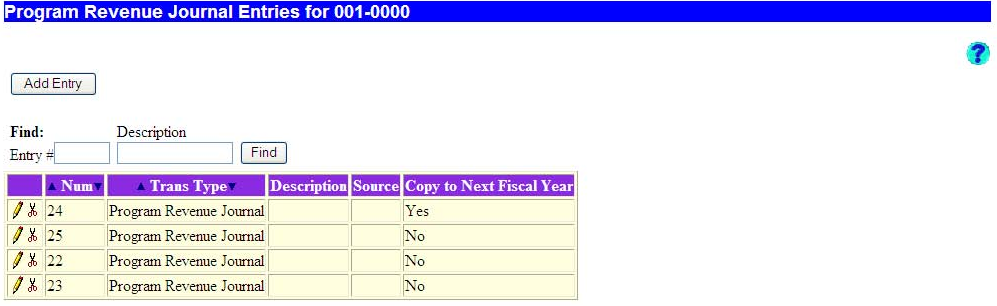

The following screen will appear:

This screen allows you to add a new entry, modify a current entry or find a particular entry. Since these journal entries differ somewhat from the generic set, more detail will be given.

Adding an Entry

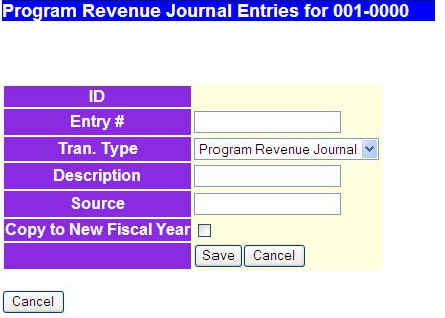

Click on the Add Entry button as seen above. The following screen will appear:

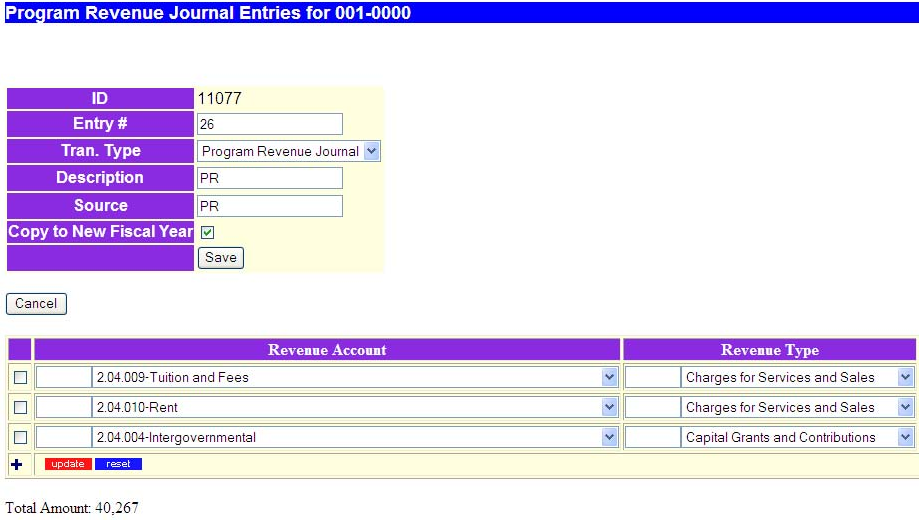

Data Fields:

- ID - System generated number. Cannot be entered or modified.

- Entry # (Num) - Transaction number assigned by the upload program or the user.

- Transaction Type - Program revenue is the only transaction type available.

- Description - General description for the transaction.

- Source - Source of the transaction - import, work paper reference, manual entry, auditor, etc.

- Copy to Next Fiscal Year - Check this box if you would like this entry to be copied over to the next fiscal year with 0 balances. When the next fiscal year is opened, the entries that were flagged to copy to next year will be created in the appropriate fund, with all the accounts used in the copied entry but with all zero amounts. The user will then be able to edit those copied entries to fill in the amounts and make any other needed changes. This should speed up data entry for “standard” entries.

- Save - Click button to save the transaction.

- Cancel - Click button to cancel the transaction.

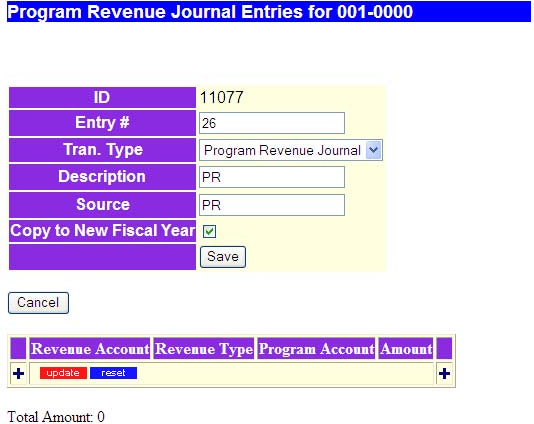

Enter data for the empty fields, and click on the SAVE button. A screen similar to the following will appear:

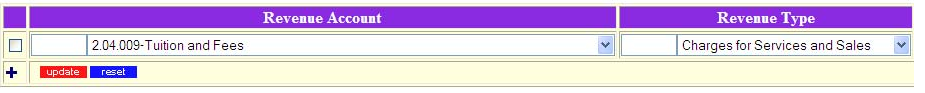

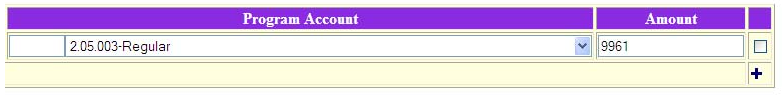

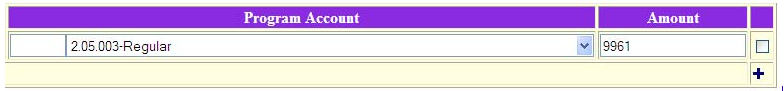

Data Fields:

- Revenue Account - The revenue being reclassified from the Statements of Revenues, Expenditures, and Changes in Fund Balance format.

- Revenue Type - Charges for Sales and Services, Operating Grants & Contributions, Capital Grants & Contributions. (Determines column on Statement of Activities)

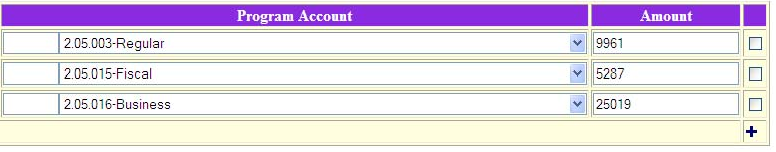

- Program Account - Program expense against which the revenue is offset to determine net program expense. (Determines row on Statement of Activities)

- Amount - Dollar amount you want to credit to the program revenue account.

(Accrual Basis)

Now click on the "+" button to add the entry. A screen similar to the following will appear:

Enter data for Revenue Account, Revenue Type, Program Account, and the Amount. Click on the red "X" to clear the entry, or on the green check mark to save it. A box similar to the following will appear:

Click on the "+" button to add more items to this entry. When finished, click on the SAVE button to enter. A screen such as the following will appear:

Modifying a Journal Entry

Click on the pencil icon to open the entry. For example use entry 1002. It should look like the following.

To make changes, go to the area on the line and begin modifying.

To save changes made to the transaction click on the "Red UPDATE" box. To cancel click on the "Blue RESET" box.

Deleting an Entry

To delete a line or lines click on the far left box, placing a check mark.

To save changes made to the transaction click on the "Red UPDATE" box. To cancel click on the "Blue RESET" box.

You will be asked to validate your choice.