Purpose: Full accrual journal entries are used to convert proprietary and fiduciary funds to the accrual basis of accounting. The data on the proprietary funds' full accrual trial balances will be used to generate both the fund financial statements and the entity-wide financial statements. The data on the fiduciary funds' full accrual trial balances will be used to generate the fiduciary funds financial statements.

Select a Fund - SCC: In order to make Full Accrual Journal entries, select and click on a specific enterprise fund. As an example, use the food service fund, 006 - 0000.

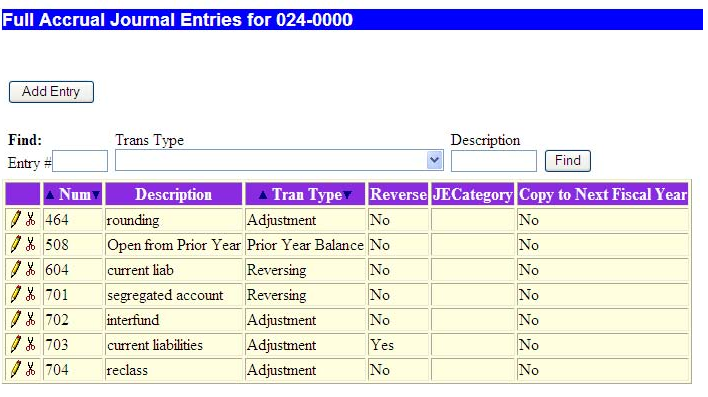

After selecting the fund, a screen such as the following appears:

The option allows you to add a new entry, or to find a current entry and to either modify or delete it.

Data Fields:

- Entry # - Transaction number assigned by the user. If the user does not enter an entry number the system will generate one.

- Find - Allows you to search the list by entry number, transaction type, or description and places the result at the top of the list.

- Transaction Type - The type determines the column on the trial balance for the entry.

Prior Year Balance Prior Period Adjustment Reversing Adjustment Audit Adjustment Reclassification Prior Year Internal Service Internal Balance Internal Service Fund(s) Internal Service Fund Internal Balances IS Fund Eliminations & Changes in Internal Balance

- Description - General description of the transaction.

- Reverse - Is this entry to be reversed? This flag is valid for adjustment and audit adjustment transaction types.

- JECategory - This optional field allows the user to enter up to 4 characters to help sort journal entries when generating journal entry reports.

- Copy to Next Fiscal Year - Check this box if you would like this entry to be copied over to the next fiscal year with 0 balances. When the next fiscal year is opened, the entries with adjustment, IS fund eliminations & changes in internal balance, prior year internal service internal balance, or reclassification transaction type that were flagged to copy to next year will be created in the appropriate fund, with all the accounts used in the copied entry but with all zero amounts. The user will then be able to edit those copied entries to fill in the amounts and make any other needed changes. This should speed up data entry for “standard” entries.

The reclassification and internal service fund entries only affect the entity-wide financial statements and not the fund financial statements.

Generic Journal Entries

The process of adding a new journal entry and of modifying or deleting a current entry is exactly the same for a variety of types of journals. These options are illustrated in detail in the Generic Journal Entry page.