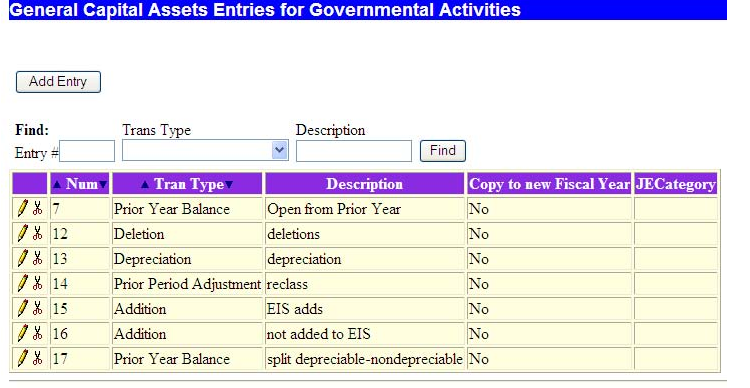

Purpose: This worksheet uses journal entries to enter opening balances and updates for capital assets in the General Capital Assets Consolidation Worksheet. When the trial balances are re-calculated, the results are then brought into the Governmental Consolidation Trial Balance. This worksheet involves only governmental activities. When this journal entry worksheet is selected, the following screen appears:

This screen allows you to add a new entry or find a current entry. It also allows you to modify or delete the entry.

Data Fields:

- Add Entry - Click the button to add an entry.

- Find - Allows you to search the list by entry number, transaction type or description.

- Entry # (Num) - Transaction number assigned by the upload program or the user.

- Transaction Types: - The type determines the column on the trial balance for the entry.

Prior Year Balance Prior Period Adjustment Addition Deletion Depreciation Capitalized Interest Audit Adjustment

- Description - Abbreviation for the transaction type.

- Copy to Next Fiscal Year - Check this box if you would like this entry to be copied over to the next fiscal year with 0 balances. When the next fiscal year is opened, the entries with addition or depreciation transaction type that were flagged to copy to next year will be created, with all the accounts used in the copied entry but with all zero amounts. The user will then be able to edit those copied entries to fill in the amounts and make any other needed changes. This should speed up data entry for “standard” entries.

- JECategory - This optional field allows the user to enter up to 4 characters to help sort journal entries when generating journal entry reports.

Generic Journal Entries

The process of adding a new journal entry and of modifying or deleting a current entry is exactly the same for a variety of types of journals. These options are illustrated in detail in the Generic Journal Entry page.